The client currently has a home loan, car loan, or credit card want to REFINANCE to combine into a loan with a lower interest rate – reducing financial pressure and making monthly loan payments easier.

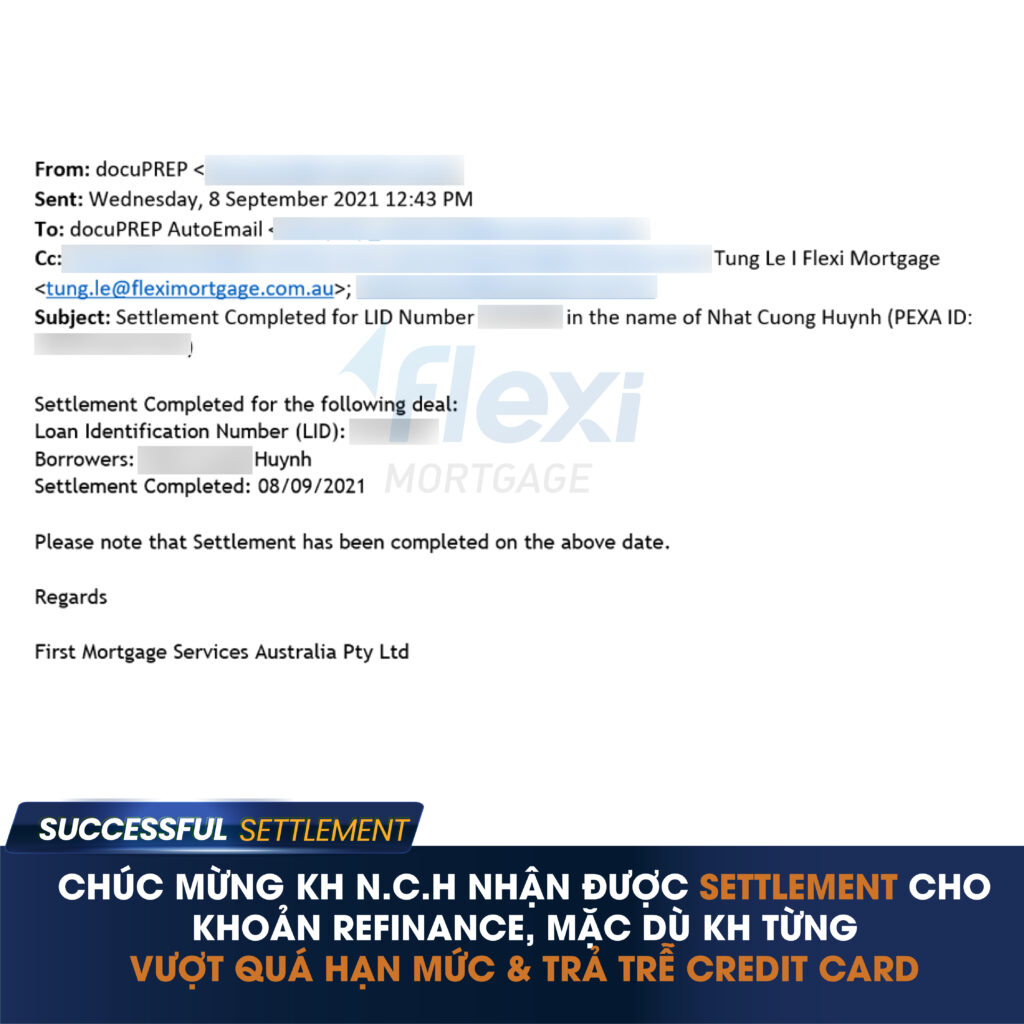

However, the client faced a problem: in the last month, he used credit card over limit & made late payment. Therefore, he was DECIDED by BIG FOUR Bank.

Flexi Mortgage has found another Bank to accept the loan with a lower initial interest rate.

And today, he received SETTLEMENT FOR YOUR LOAN REFINANCE UP TO $615,000 with 2.59% interest – lower than original.

OUR ADVICE WHEN REFINANCE: Before deciding to REFINANCE, in the last 3 months you should pay your loans and credit cards on time, making your profile more beautiful - borrowing more effectively.

According to CoreLogic's report, after the House prices increased sharply in June 2021, up to now house prices have continued to increase by 1.6% (updated July 31, 2021).

In addition, due to the impact of COVID-19, loan interest rates are at a disciplined low and it is expected that interest rates will remain low for a long time.

This is the best time for REFINANCE – you can withdraw the difference in the amount of the house compared to the original purchase price, to serve your personal needs such as buying a car, repairing a house, building a granny flat to have additional income or investment needs such as buying a business, buying more rental properties.

Fill in the information to receive PROPERTY REPORT – KNOW THE VALUE OF CURRENT HOUSE

The report will be sent to you within 1-3 business days. NOTE: The report is only sent to customers who OWN the real estate that the customer subscribed to. NOT APPLICABLE to customers who have NOT BUYED/INTENDED TO BUY.